2023 proposed budget includes 2-cent reduction in property tax rate

Published on August 09, 2022

Fort Worth’s homeowners could see the City’s property tax rate drop 2 cents if the City Council considers a new rate as part of the fiscal 2023 budget process.

City Manager David Cooke proposed the decrease when he put before council members a $915.3 million General Fund budget Tuesday. The City’s overall budget will top $2.3 billion.

Water rates, garbage collection fees and stormwater fees are not going up.

“Again this year, the City’s economic outlook is positive, even as we continue to feel long-term effects of the COVID-19 pandemic,” Cooke said. “We’re seeing gains in local job growth, property values, sales tax collections and new building permits. But along with Fort Worth’s impressive population growth come increased demands on City services and infrastructure.”

Cooke said City staff is being even more mindful in this budget cycle about how to achieve goals of making Fort Worth a more livable and vibrant city. He said it is important to show residents the City is being a good steward with their money, but at the same time improving their quality of life.

How programs and services are provided for future generations is always an underlying budget goal, Cooke said. That’s become a little more difficult this budget cycle because the City is also experiencing cost increases and the pressures of the current economy and job market.

“The budget is a process and a path that are years in the making,” Cooke said. “We have to be thinking about the future. It’s about today and also what we’re doing in the long-term.”

Property tax rate reduced again

Cooke recommended reducing Fort Worth’s property tax rate to $71.25 cents per $100 assessed valuation. The reduction is needed to help residents achieve an affordable lifestyle as consumer prices continue to rise.

The owner of a home valued at $200,000 would pay $1,425 in City property taxes. Exemptions would change the final amount of the tax bill.

New positions deliver improved service

The recommended budget is an increase of 10% over the fiscal year 2022 adopted budget, or about $83.4 million. It is one of the largest increases in recent years, but needed to keep up with growth and maintaining infrastructure, Cooke said.

Monies will pay for bridges and road maintenance, further improve neighborhoods and place renewed focus on picking up litter and making roadways brighter at night.

The new budget includes about 300 new positions, with about 200 of those paid for in the General Fund. Those include 40 new positions in the Development Services Department. Police will gain 71, which includes 45 new officers who will be on the streets in fiscal 2024; 23 new jobs in Fire, and 14 to staff a new library.

The additional positions in Development Services will help provide faster and more efficient service to both developers planning large-scale projects and homeowners tackling improvements around the house.

Pay-as-you-go expansion

For the fiscal 2023 budget, Cooke proposes allocating 7 cents of the 71.25 cents tax rate to Pay-as-you-go, or PayGo. The boost, coupled with the impact of higher appraisal values, will put $12.3 million more into the fund that uses cash to pay for projects. That will total $65.2 million.

Among other things, money for street maintenance will jump 34.5%, from $35 million to $47 million. Streetlight maintenance will increase by $3 million. Funds for pavement markings will increase to $6.5 million.

Focus on a cleaner Fort Worth

To help foster a visibly cleaner Fort Worth, City staff is proposing an increase in the monthly environmental fee that many residents see on their utility statements. The increase is needed to put more money behind litter cleanup and illegal dumping enforcement.

The current fee is 50 cents monthly for single-family residences. Under the proposed increase, the first since the program began in 1996, a homeowner will pay $1.50 per month. Monthly fee increases are also proposed for commercial, industrial and nonprofit properties, which makes the distribution of the fee equitable across all properties.

The proposed increase would add $6 million annually, and expand capacity for other environmental projects and services, such as $4 million for street sweeping. The environmental fund will increase to $16.1 million, up from $4.9 million. The new amount includes the transfer of $4.4 million from the Solid Waste Fund.

Watch City News for more details on many of these topics over the coming weeks.

Plenty of opportunities to give feedback

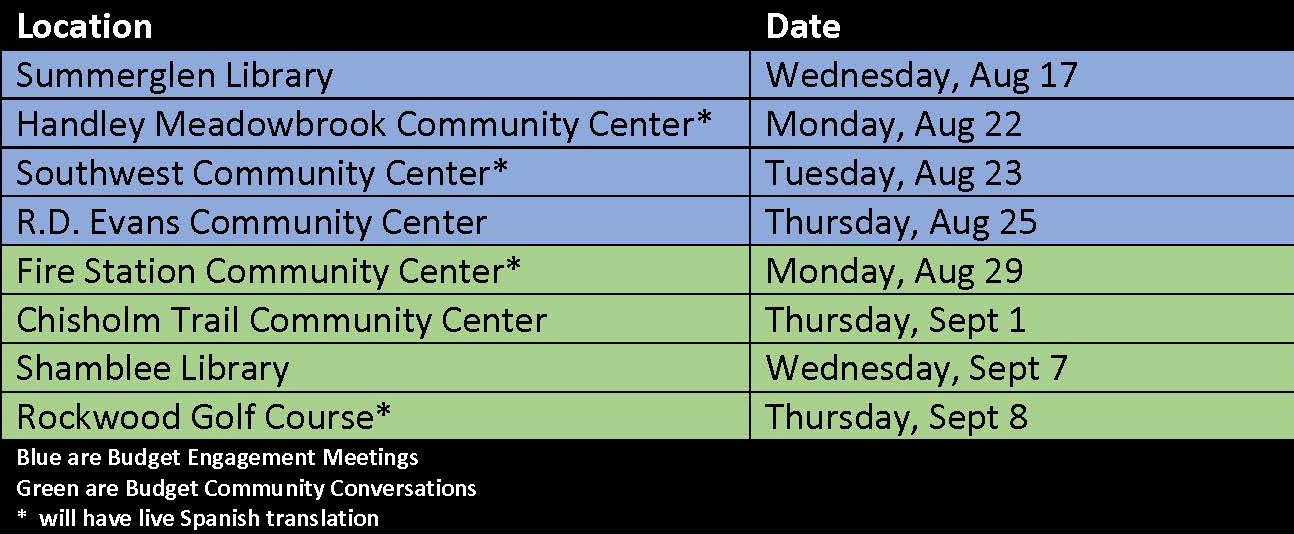

Fort Worth residents have many opportunities to speak on the proposed fiscal 2023 budget. A series of community engagement meetings will be held at geographically dispersed locations across Fort Worth. The dates and times of these meetings are below. The dates in blue boxes are City Budget Meetings; the dates in green boxes are Community Conversations.

All in-person meetings begin at 6 p.m. and will include an educational and informative budget presentation. The mix of meeting styles includes City Budget Meetings, where participants can interact and discuss key, proposed components of departmental budgets with representatives, then participate in a Q&A session with City leadership. Additionally, there will be Budget Community Conversations where attendees will have the opportunity to share thoughts on the proposed budget and ask questions by participating in a conversation circle. Several of the meetings will have live, Spanish language translation.

Residents who may want to engage in ways other than in-person have opportunities as well. The interactive ThoughtExchange platform will allow residents to digitally share their thoughts and opinions on the proposed budget and in a variety of languages. Additionally, comments can be submitted through an online comment form, the MyFW app, which has a link to the online comment form, by sending an email or by calling the City of Fort Worth Call Center at 817-392-1234. Call center staff will note comments in English or Spanish.

Residents can also provide comments to the City Council during meetings scheduled at City Hall, 200 Texas St.:

- Public comment meeting, Tuesday, Aug. 16, 6 p.m.

- Public hearing on City budget, Tuesday, Sept. 13, 6 p.m.

- Public hearing on tax revenue increase, Tuesday, Sept. 27, 10 a.m.

View more details on the City’s budget webpage.

The City Council is scheduled to vote on adopting the budget and the tax rate at 10 a.m. Tuesday, Sept. 27, at City Hall.