Proposed City budget will drop property tax rate

Published on August 22, 2022

What is under consideration? The Fort Worth City Council is considering lowering the property tax rate by 2 cents.

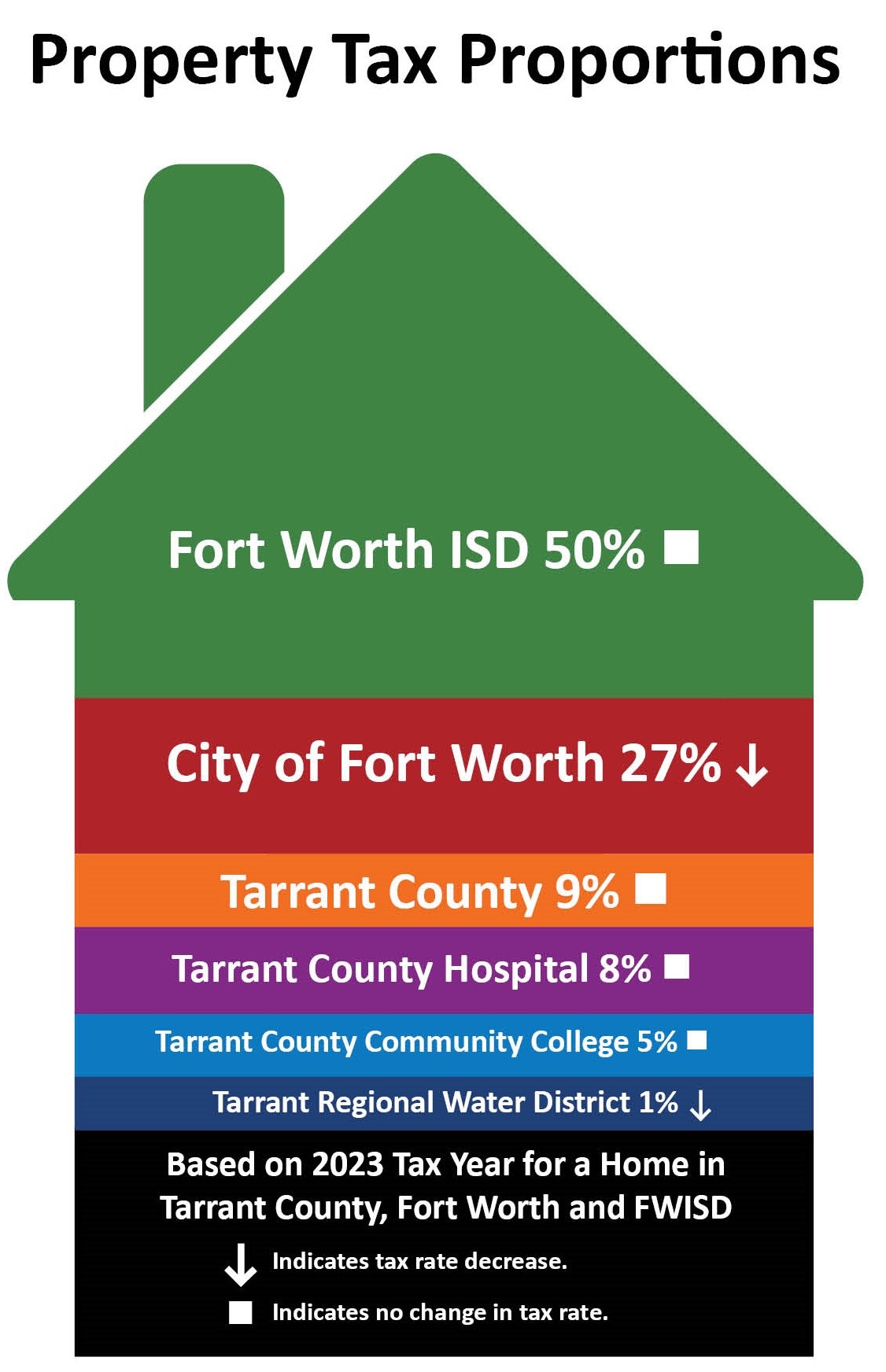

Why does the tax rate matter? The tax rate is used to calculate property tax bills for all property owners. Property tax revenues go into the General Fund to pay for city services and operations, including police, fire, libraries and parks. The City portion of the overall tax bill is about 27%.

What does this mean to taxpayers? The City Council understands the potential tax burden on homeowners and typically considers lowering the tax rate when property values increase.

What’s next? Residents can address the proposed tax rate at upcoming Budget Engagement Meetings. The council is expected to vote on the tax rate Sept. 27.

For the second consecutive year, Fort Worth homeowners could see a decrease in the City’s property tax rate.

City Manager David Cooke has recommended the council lower the tax rate 2 cents, to 71.25 cents per $100 assessed valuation. Although the tax rate goes down, a property tax bill could increase depending on the property appraisal.

The City Council has lowered the tax rate five times in the past six years, totaling 12.25 cents. The rate has gone from 85.50 cents per $100 assessed valuation in fiscal 2016 to 73.25 cents per $100 assessed valuation in fiscal 2022.

The Tarrant County Appraisal District added $12.5 billion in appraised value in 2022 to all Fort Worth real property, increasing the market value of homes and commercial properties to $125.6 billion, up 14.5% from the previous year.

The public can comment on the proposed tax rate during upcoming public hearings on the fiscal 2023 budget, beginning Tuesday, Aug. 16. The council is scheduled to approve the tax rate Tuesday, Sept. 27. Additionally, there will be a series of education and engagement opportunities, both in-person and online.

The City’s proposed tax rate of 71.25 cents per $100 valuation is 1.25 cents higher than the no-new-revenue rate of 70 cents. If adopted, the proposed rate would raise an extra $73 million in additional revenue.

Learn more about the City of Fort Worth budget and opportunities for engagement.

Get articles like this in your inbox. Subscribe to City News.