Council adopts budget with 2-cent reduction in property tax rate

Published on September 27, 2022

The City Council passed a budget that adds money to the annual operations budget for public safety improvements and to clean up litter across the city.

The City’s overall fiscal 2023 budget is approximately $2.3 billion.

The Council by a 7-2 vote approved a $915.3 million General Fund budget, which pays for most city services and operations. The Council also voted 7-2 to decrease the City’s property tax rate 2 cents. District 3 Councilmember Michael Crain and District 4 Councilmember Alan Blaylock voted against both the budget and the tax rate.

The General Fund budget is an increase of 10% over the fiscal year 2022 budget, or about $83.4 million. The increase is needed to keep up with growth and maintaining infrastructure, City Manager David Cooke said.

Cooke said the budget was crafted to make Fort Worth a more livable and vibrant city while improving residents’ quality of life. That task became more difficult this year because the City is also experiencing cost increases and the pressures of the current economy and job market.

The budget will pay for enhanced bridge and road maintenance, improve neighborhoods and put emphasis on picking up litter and making roadways brighter and safer at night.

Water rates, garbage collection fees and stormwater fees are not going up. An environmental fee on monthly utility bills will increase for both residences and business properties. The fee has not increased in 25 years.

Property tax rate reduced again

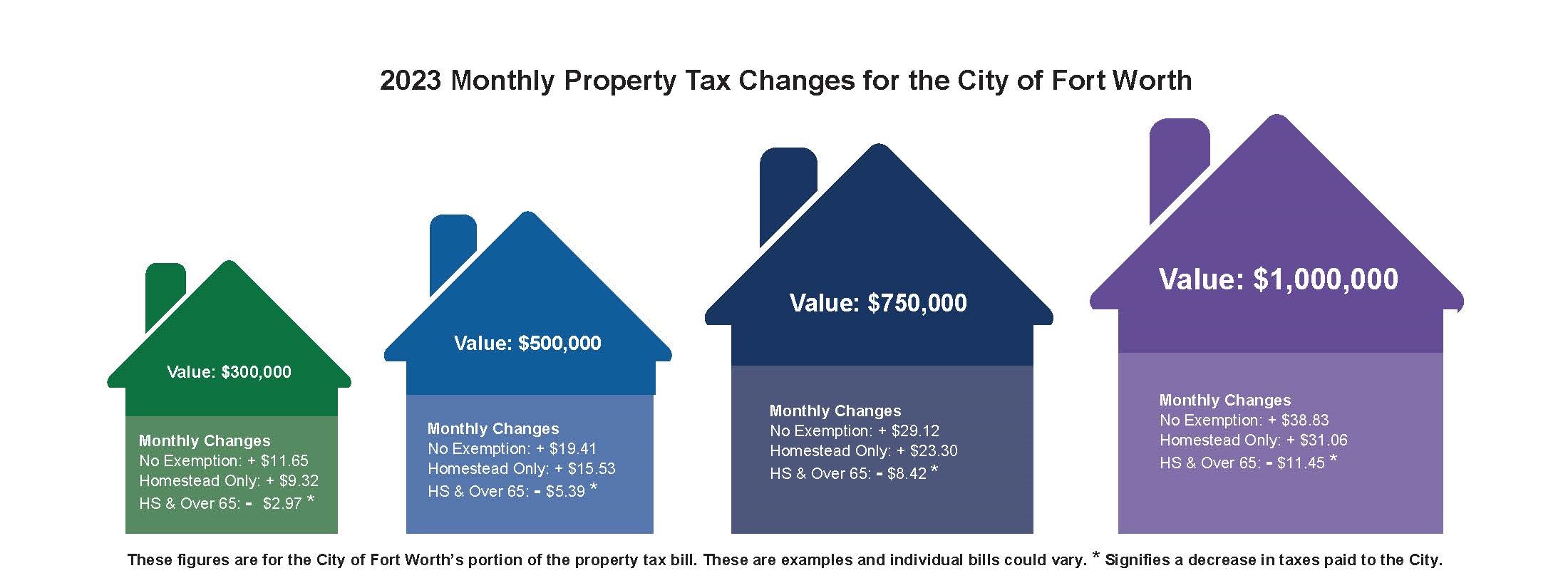

The Council approved reducing Fort Worth’s property tax rate to 71.25 cents per $100 assessed valuation. The reduction aims to help residents achieve an affordable lifestyle as consumer prices continue to rise.

Although the tax rate is going down, a property tax bill could increase, stay the same or decrease, depending on the property appraisal. The owner of a home valued at $200,000 would pay $1,425 in City property taxes. Exemptions, such as the homestead exemption and age 65 and up exemption, would change the final amount of the tax bill.

The City Council has lowered the tax rate five times in the past six years, totaling 12.25 cents.

New positions deliver improved service

The budget includes new positions to support growth and to enhance service levels.

The City’s Development Services department is getting one of the largest staffing increases outside of public safety, with 38 new positions. The additional positions will help provide faster and more efficient service to developers and homeowners.

The Police Department will gain 90 new positions, including 73 sworn officers. The Fire Department will grow by 14 civil service positions to staff a new engine company in Far North; two additional positions for the homeless outreach team, and seven civilian support staff.

Pay-as-you-go expansion

Cooke allocated 7 cents of the 71.25 cents tax rate to Pay-as-you-go, or PayGo. The boost, coupled with the impact of higher appraisal values, will put $12.3 million more into the fund that uses cash to pay for projects. That will total $65.2 million.

Identified PayGo projects will include street maintenance, up 34.5%, from $35 million to $47 million. Another $2.6 million will help fix the backlog of street light outages, up from $1.5 million, and $6.5 million for pavement markings, up from $1.4 million, a 357% increase.

Focus on a cleaner Fort Worth

To help foster a visibly cleaner Fort Worth, a monthly environmental fee that many residents pay on their utility statements will increase. The added revenue will go toward litter cleanup and illegal dumping enforcement.

Starting in January, a single-family homeowner will pay $1.50 per month, up from 50 cents. Monthly fee increases are also proposed for commercial, industrial and nonprofit properties.

The fee increase is the first since the environmental program began in 1996.

The increase will add $6 million annually and expand capacity for environmental projects and services, such as $4 million for street sweeping. The City plans to buy 10 street sweepers.

CCPD budget approved

Earlier this month, the City Council and the Crime Control & Prevention District board, consisting of the City Council members, approved a $117.7 million CCPD budget. The new budget is up more than $22 million from the 2022 budget.

Increased investment with community partners and expanding the crossing guard program to cover Fort Worth middle schools are among the significant changes. The total cost of the crossing guard program for all covered schools is $3.7 million.

CCPD funds will also add positions to the HOPE homeless crisis team, neighborhood policing and the Crisis Intervention Team.

Other budget notes

- The City will increase the number of work crews devoted to repairing streetlights. Transportation & Public Works is adding 11 positions to improve response time to repair street lights. The added crews will cut in half the time it takes to make repairs.

- The budget includes an increase of $771,920 to expand the Library’s collection of books, eBooks and resources available to the public.

- Code Compliance is adding seven positions to help regulate high-density multifamily rental properties across the city.

View more details on the City's budget webpage.